Business

Samsung announces earnings guidance for Q2 2021, beats estimates amid pandemic

Samsung has just announced its earnings guidance for the second quarter of 2021. The report reveals that this year, Samsung’s earnings for the second quarter greatly exceeded the expectations of analysts. It is estimated that industry results have been achieved as sales performance exceeds expectations in the semiconductor memory business and a single profit from the display business is reflected in the accounting records.

According to the report, Samsung announced a record 63 trillion won in sales and 12.5 trillion won in combined earnings in the second quarter. Compared to the previous quarter, sales decreased by 3.65%, but operating profits increased by 33.26%. Compared to the second quarter of last year, sales increased by 18.94%, and operating profits worked by 53.37%.

- Consolidated Sales: Approximately 63 trillion Korean won

- Consolidated Operating Profit: Approximately 12.5 trillion Korean won

Join Sammy Fans on Telegram

This performance exceeded the expectations of analysts. The sales of the second quarter to Samsung Electronics, initially expected by security firms, were at a low of 60 trillion won, and operating profits have earned 11 trillion won.

- Sales: 62 ~ 64 trillion Korean won

- Operating Profit: 12.4 ~ 12.6 trillion Korean won

The industry expects that the business performance of semiconductor memory is significantly reduced. According to DRAM Exchange, a market research company, DRAM prices increased 26.67% (based on standard PC products) compared to the previous month in April, at the beginning of the second quarter. NAND flash also increased by about 9%.

It is expected that the nearly 500 billion won of one-time compensation received by Samsung Display from its customers Apple, that reflected in their accounting records, which had a positive impact on the company’s overall profitability.

Samsung Electronics explained that in order to strengthen contact with investors and improve comprehension, questions about management status are received early on the website.

STAY CONNECTED WITH US:

- Like SammyFans.com on Facebook

- Follow SammyFans on Twitter

- Get the latest insights through Google News

- Send us tips at – [email protected]

Business

TSMC strikes on Samsung with another positive quarter

Samsung is one of the world’s largest chipmakers, which got badly affected by the global market downturn. In the fourth quarter of 2022, the market share gap between Samsung and TSMC further widened. TSMC managed to face the market loss with less drop in sales compared to Samsung Elec.

Follow our socials → Google News, Telegram, Twitter, Facebook

According to a recent TrendForce report, TSMC grabbed a whopping 58.5 percent share of the foundry market, securing the first rank. Samsung Electronics maintained its second rank in the market with a 15.8 percent share, with a gap of 42.7 percent.

“TSMC was able to increase its market share as its foundry competitors underperformed. Samsung lost a large share of its orders as Qualcomm and Nvidia placed orders for sub-7nm semiconductors for flagship products with other companies.” – TrendForce

It’s worth mentioning that the growth and decline are not just limited to Samsung Electronics and TSMC. The entire global foundry industry posted a decline in revenue in Q4 2022 because foundry customers, fabless companies that specialize in semiconductor design, decreased their orders due to inventory issues.

Samsung and TSMC at the cutting edge of technology, saw quarter-over-quarter revenue declines of 3.5 percent and 1 percent respectively, while mid-tier foundry companies were hit harder. They were a 12.7 percent drop in revenue for third-place UMC, 27.3 percent for PSMC, and 30.3 percent for VIS.

Last but not least, China’s SMIC and Hwahong Semiconductor also recorded drops of 15 to 26 percent. In the aftermath of this, China’s Nexchip dropped out of the top 10 list, and DB HiTek, a mid-sized foundry company in Korea, joined the top 10 clubs instead.

Business

Samsung faces $2.3 billion loss in first two months of 2023: Report

2023 begins as a bad year for Samsung Electronics’ memory chip business as the division lost $2.3 billion in the first two months of 2023. According to koreajoongangdaily source, the company lost 3 trillion won in January-February, and it’s expected to continue throughout the first quarter of 2023.

According to the report, the company estimates that the operating loss could reach up to 4 trillion won by the end of the first quarter. Due to the global economic downturn, it’s going to be the first loss for the division since the fourth quarter of 2008.

“Internally, there was a report projecting up to 4 trillion won in operating losses from the memory chip business in the first quarter,” koreajoongangdaily source said.

Samsung Elec reportedly borrowed 20 trillion won from its Display division to help in the funding of semiconductor investments. The company said that it will maintain this year a similar level of capital expenditure as last year without any plan to “artificially” cut back production of semiconductors.

Among all divisions, the DV division is Samsung’s most profitable business, which was significantly affected at the end of last year. The decreasing semiconductor business is expected to get recovered only after the global shortage and economic downturn lessens.

In 2022, Samsung’s chip division brought in 23.8 trillion won of operating profit. The business’s operating profit came in at 8.5 trillion won in the first three months, 9.9 trillion won in the second and 5.12 trillion won in the third. However, it reduced by 97 percent YoY in Q4 as the division posted a 270 billion won profit.

As per TrendForce report, DRAM prices will likely slide 20 percent in the first quarter and another 11 percent in the second quarter, which already faced a 34 percent decline in 2022. Moreover, NAND flash chips will go down 10 percent in the first quarter and 3 percent in the second.

Follow our socials → Google News, Telegram, Twitter, Facebook

Business

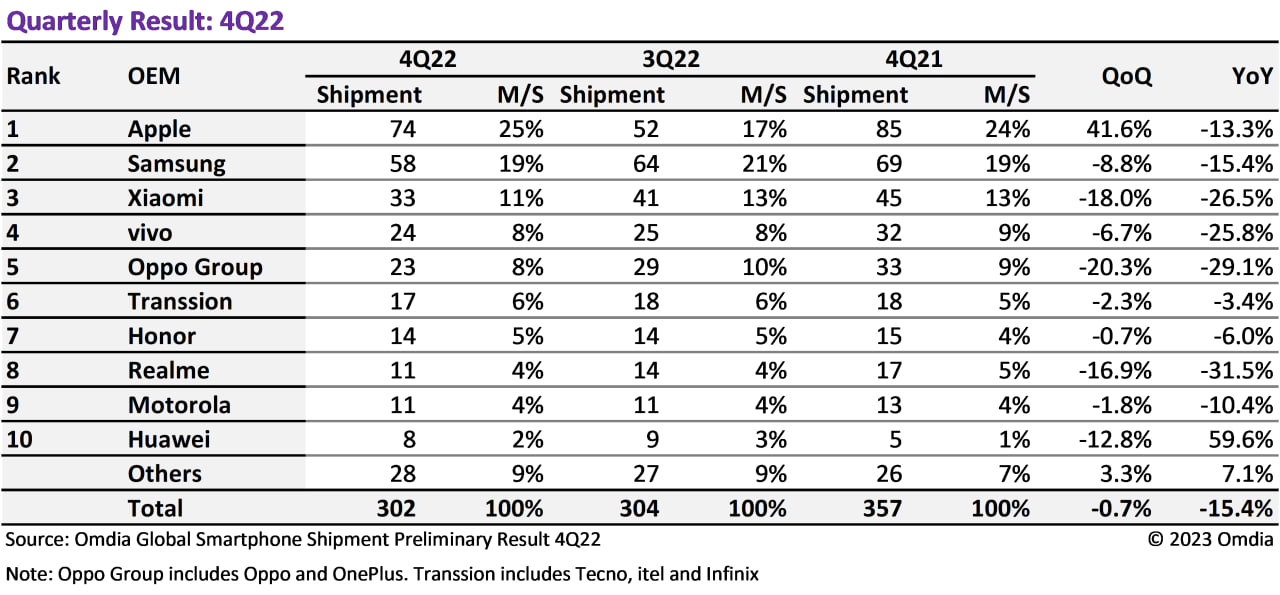

[Omdia] Samsung fell but ruled 2022 smartphone market, what about others?

Omdia Analysis Highlights:

- Samsung sold 259 million smartphones in 2022

- Apple was the biggest smartphone vendor in Q4, 2022

- Samsung’s market share declined by 4.8% YoY

Omdia’s smartphone preliminary shipment report// In the fourth quarter of 2022, global smartphone shipments totaled 301.5 million units, which is the same as the third quarter, but decreased by 15.4% YoY. Usually, Q4 sees the most shipments but this year’s last quarter faced a drop of 0.7% than the previous quarter.

In Q4 2022, Apple sold 74 million units of iPhone models, however, shipments increased by 41.6% from the previous quarter, and fell by 13.3% year-on-year. Samsung, as per previous trends, dropped from first place to second place with shipments of 58 million units and a 15.4% drop YoY.

Follow our socials → Google News, Telegram, Twitter, Facebook

2022 was the worst year for the smartphone market with overall shipments of 1.207 billion units, a year-on-year decrease of 9.9% from 1.34 billion units last year. Samsung’s final shipments in 2022 will be 259 million units, ranking first in the world, but compared with 2021’s 272 million units, it will drop by 4.8%.

The most affected are manufacturers in China, with shipments of Xiaomi, Vivo and OPPO all dropping by double digits year-on-year. Honor is the only major player with year-on-year growth, reaching 59 million units in 2022, compared to 40 million units in 2021.

In recent quarters in 2022, most Chinese manufacturers have continued to decline. Xiaomi, Vivo, and OPPO ranked third to fifth respectively in the fourth quarter, whereas shipments fell by over 25% year-on-year. Talking about shipments, Xiaomi 33 million, Vivo 24 million, and Oppo 23 million.

Transsion ranked sixth in shipments in the last quarter, reaching 17 million units, slightly lower than the previous quarter and last year’s 18 million units. Honor’s shipments totaled 14 million units in the fourth quarter, in line with the previous quarter, but slightly down from 15 million units last year.

Realme ranked eighth with sales of 11 million units, facing a 16.9% decline from the previous quarter and a massive 31.5% decline from the previous year. It is surprising that realme has fallen more and faster than its mid-to-high-end price-focused competitors, possibly due to inventory problems in 2022.

Motorola ranked ninth with sales of 11 million units, flat with the previous quarter, but down 10.4% from the previous quarter. Huawei maintained its tenth place, with shipments of 7.5 million units, down 12.8% QoQ, but, with a sizzling jump by about 60% than the last year.